Central Know Your Customer (CKYC)

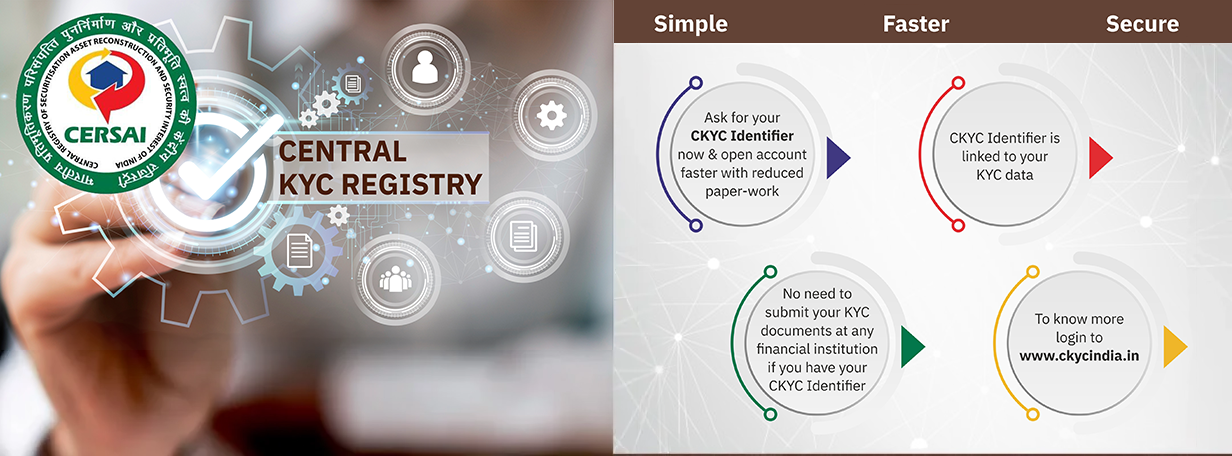

Central KYC (CKYC) is an initiative by the Indian government designed to simplify the Know Your Customer (KYC) process for investors and financial service providers. It establishes a centralised repository where customers can submit their KYC documents once and use the same record across various financial institutions, eliminating the need to repeat the process.

To successfully register with CKYC, customers must fill out the CKYC form completely and accurately. The form collects key information such as personal details, PAN numbers, proof of address, bank account details, and more. Once the submitted records are verified against the documents in the CKYC repository, the customer is assigned a unique 14-digit identification number linked to their Aadhaar. This centralised database enables financial institutions to access customer information seamlessly, ensuring efficiency and consistency in KYC compliance.

CKYC Benefits

- Time and Cost Efficiency: CKYC streamlines the KYC verification process, reducing both time and costs significantly.

- Document Simplification: Customers need not submit KYC documents repeatedly, provided there are no changes to their existing CKYC records.

- Centralized Repository: As a unified database of KYC records, CKYC can be utilized across all financial products nationwide.

- Enhanced Customer Experience: CKYC simplifies access to financial services, improving the overall customer journey.

- Operational Efficiency: By enabling banks and financial institutions to seamlessly access and manage customer information, CKYC enhances service delivery and operational efficiency.

For more information customer can visit: https://www.ckycindia.in/

CKYC Terms and Conditions

Central KYC Registry is a centralised repository of KYC records. Once the KYC documents are submitted by an individual, they are registered in the repository with a unique CKYC number. The CKYC number can be quoted instead of submitting physical KYC documents for any financial transaction. The CKYC repository can be accessed by all financial institutes for verifying the KYC details of their customers.

Once your KYC details are registered with CKYC, you will receive a 14 digit KYC Identification Number (KIN) number which you can quote for any kind of financial transaction and you don't have to submit your KYC documents again unless there is a change in your KYC details.

- CKYC Details are fetched basis user's consent on our app/platform.

- The details fetched are purely based on CERSAI (Central Registry of Securitisation Asset Reconstruction and Security Interest of India) and we do not alter any of the data.

- The user is solely responsible for the authenticity of the data shared with the LoanFront App/Platform

- We do not share the CKYC details with any of the technology partners .

- Any changes to the KYC data must be submitted to CERSAI for updating the customer's CKYC data.